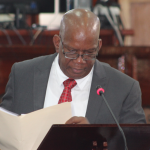

The 2019 Budget which was presented by Finance Minister Winston Jordan today in the National Assembly outlines a number of fiscal adjustments, which he believes, will provide benefits for employees and senior citizens.

The $300.7 Billion budget was presented under the theme: “Transforming the Economy, Empowering People, Building Sustainable Communities for the Good Life.”

Old Age Pension

According to the Finance Minister, the Old Age Pension will be increased from $19,500 to $20,500 – an increase of 5.1 per cent – in 2019.

He also proposed an increase in Public Assistance from $8,000 to $9,000. Minister Jordan boasted that this brings the increases to the two programmes to 55 per cent and 53 per cent, respectively, since the Coalition Government took office in 2015.

With the two coupled, the Minister noted that both increases, which take effect from January 1, 2019, will result in persons taking home an additional $800M in 2019.

Income Tax Threshold

In relation to the income tax threshold, the Finance Minister revealed that in 2019 this will be raised to $780,000 or one-third, whichever is greater. The tax threshold for 2018 was $720,000 or one-third.

He noted too, that this represents a 30 per cent increase in the threshold, since the Government came to office in 2015, and approximately $805M being returned to taxpayers for that year.

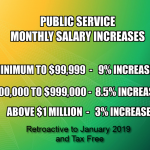

Earlier in his presentation, the Minister had disclosed that minimum wage for public servants would be increased from $60,000 to $64,200. However, he noted later down in his presentation that in addition to this, wages and salaries of public servants will be increased in 2019, after discussions with the respective unions.

VAT

Meanwhile, for 2019, there will be no adjustment in the Value Added Tax (VAT) regime. However, several new exemptions were proposed by the Minister. Among these are:

Exemption from VAT, aircraft engines and main components/parts;

Exemption from VAT, concrete blocks used for housing and construction. This follows the exemption from VAT on complete housing units up to $6.5 million

Exemption from VAT, equipment and chemicals for water treatment and production plants.

Exemption from VAT, orthopedic appliances and artificial parts of the body

Exemption from VAT, Educational Robot Kits, in order to boost the ―Reading & Robotics‖ programme targeted to children in communities all across Guyana; to encourage more young people to become avid readers; and to develop necessary soft skills like communication, collaboration and conflict resolution.

Exemption from VAT, boats used in rural and riverain areas designed for the transport of goods and persons not exceeding 7.08 cubic metres (250 cubic feet). The import Duty of 5% will also be waived.

Persons with disabilities

Differently abled persons will also benefit from Excise Duty and VAT, Minister Jordan announced. He said that vehicles used by these persons or vehicles that will be converted for their use will benefit from these introductions. However, he noted that these vehicles “must be able either to be driven by the disabled person, or designed for such a person”.

Further, Government will examine the feasibility of granting a tax rebate on handsets with accessibility features for persons living with disabilities, he revealed. (by Ravin Singh)

You must be logged in to post a comment Login